Like every year, the first Tuesday in May is MarTechDay, an event where industry experts Scott Brinker and Frank Riemesma take stock of the situation in the market. Here is a summary of the most interesting trends and thoughts.

Before delving into the data we have selected, a necessary premise on the meaning of the term MarTech.

MarTech stands for Marketing Technologies and refers, as you might guess, to the set of software that supports marketers in achieving their goals.

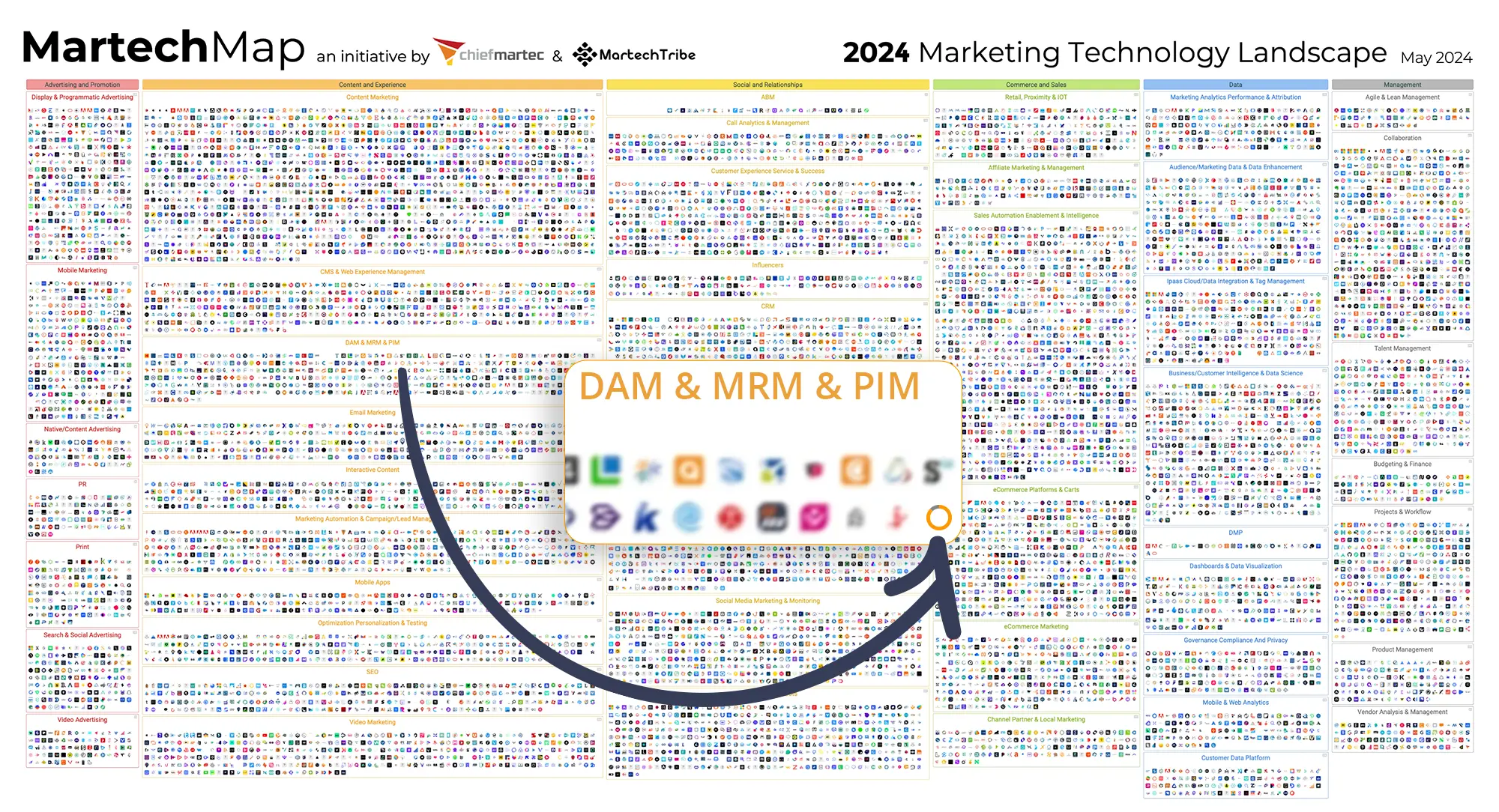

Scott Brinker, VP of HubSpot and author of chiefmartech.com, has been analysing the global marketing tools landscape for years and has been publishing the annual Marketing Technology Landscape since 2011.

The map tracks and ranks these tools and, together with surveys and insights, is released on MarTechDay, a much-awaited event for those involved in technology and/or marketing.

In particular, the Landscape divides the MarTech tools into six macro-categories:

Each of them contains within it numerous sub-categories; for example, THRON PLATFORM has been included in the DAM & MRM & PIM sub-category of the Content & Experience category for years.

From the insights of the 2024 edition, streamed on 7 May, we have selected five; and the first is based on the Landscape volumes.

Landscape 2024 found 14,106 MarTech software on the market.

A gigantic number, the size of which is even more appreciable in perspective. Compared to 2023, the increase is about 28% over previous years, with a compound annual growth rate of 41.8%.

In a few issues ago of NORTH – our 50% newsletter and 50% North Star – we discussed market consolidation, i.e. the reduction of MarTech tools available to companies. Were we wrong? Not really.

Although it appears to be a concept at odds with the figure above, Brinker and Riemesma agree that the competitive landscape of marketing technologies will increasingly tend to consolidate, i.e. stabilise first and then shrink slightly.

This is a process that in part is already underway – albeit eclipsed by the countless start-ups that have entered MarTech in recent months – supported by the acquisitions of the Big Players and, above all, stimulated by the goal of organisations to contain the complexity and budget of their IT ecosystem.

If supply grows and demand for MarTech solutions falls, then what can we expect?

The report is clear: despite the ongoing simplification of IT stacks, it is pure utopia to think of a very small number of large platforms offering a wide range of features and satisfying all business needs.

The long tail of solutions populating the market is fuelled by small, sometimes very small, technology providers that listen, interpret and innovatively fulfil niche needs that could hardly be met by MarTech giants such as Adobe, Google, HubSpot and Salesforce, to name a few.

However, in order to support digital simplification and the alleviation of IT costs, MarTech providers are – and will increasingly be – called upon to ensure increasing levels of versatility in their product offerings.

We ourselves have noticed, for example, that from the very first contacts, companies that choose us as their provider are increasingly aware of the benefits to the digital ecosystem provided by a single platform such as THRON, which includes DAM software and PIM software.

Concentrating a substantial amount of workflows in a single solution not only reduces investment in software fees, but also minimises the development and maintenance costs of integrations.

Marketing automation platforms are the most common type of MarTech solutions in the companies’ IT stack (88%), followed by CRM (84%) and BI (69%), trailing DXP (54%) and CDW (48%).

In more than one in three of the surveyed companies’ stacks, workflow platforms, CDP (both 37%) and Digital Asset Management (36%).

Artificial intelligence is the undisputed star of the last few months.

Of the 159,000 solutions in OpenAI’s GPT Store, Brinker and Riemesma identified more than 3,000 focused on MarTech, although they chose to include only a few of them in the MarTech Landscape count.

In any case, the overall breakdown of the types of functionalities offered is interesting, with one third of GPTs’ MarTech tools focusing on content marketing, no doubt due to the enormous leap in quality of generative AI.

This is followed, far behind, by SMM, SEO and collaborative tools.

We close this round-up by talking about what is commonly called the Dunning-Kruger effect, a cognitive bias whereby people with limited skills in a specific area tend to overestimate their capabilities, while those with high skills, on the contrary, underestimate them.

The MarTech experts noted this by asking a thousand companies to self-assess their IT stack after deploying it; they found that 30 per cent of companies deemed more ‘MarTech-mature’ by the experts who conducted the study self-assessed with lower average scores than the 70 per cent of companies deemed more ‘MarTech-immature’.

Sometimes, therefore, abstracting one’s gaze from the particular to focus on the general can be indispensable in order to have a perception of one’s organisation more in line with reality. Whether one tends to overestimate it or underestimate it.

That is also why every third Wednesday of the month we publish NORTH, our newsletter for marketers, IT, CIOs, e-commerce managers and digital specialists who want to keep an open window on what is going on around them.